Yesterday's Annual Budget meeting took place in Lifford

CEO of Donegal County Council John G. McLaughlin said that €185m was the “largest ever budget” which Donegal County Council had ever overseen at Wednesday’s annual budget meeting in Lifford.

It also included a capital budget of €248million, Cathaoirleach Cllr Martin Harley also pointed out.

There was a €10million increase on the previous year's budget and it would be the sixth year in succession that there had not been an increase in commercial rates and there had been no increase to service charges.

However, CEO McLaughlin pointed out that there were weaknesses in the overall council funding model, with the pressure of demands for increased services, while operating within a tightening global financial environment.

He also acknowledged that the provision of housing is a huge challenge in every county including social housing tenants, people seeking to get on the property ladder, workers moving location as well as older people looking to “right-size” their home.

The total payroll and pension cost for 2024 will be €94,159,417 (revenue and capital), Head of Finance Richard Gibson later explained.

Introducing the annual budget proposals to members, Mr McLaughlin said: ”This Draft Budget provides for expenditure in the sum of €185,577,941 for the year ending 31st December 2024. It is a very challenging but positive budget, in the midst of the effects of high inflation costs over the last two years and the consequential cost on running the business of the Council.

He said the significant “cost of living” crisis across all of Ireland and much of the world that was in full force last year has continued into 2023. Much of this has been attributed to the effects of the war in Ukraine with the linked sanctions in Russia which has had a particular disruption on the costs of energy.

“The cost of the Council’s services and contracts have increased significantly right across all divisions. The cost implications have had to be dealt with by obtaining additional funds and by adjusting other components to meet the budget available.”

He explained that the Council has not increased Commercial Rates in years 2019, 2020, 2021, 2022 or 2023. The Commercial Rate multiplier for 2024 has not been increased above the indicative ARV of 0.232 advised to businesses and commercial property owners during the countywide revaluation in 2023.

“However, given the six consecutive years of no increase in Commercial Rates multipliers, the rising costs facing the Council in carrying out its business and the need to provide for much needed work, it is expected that Commercial Rates will need to

increase in future years, and it is planned to engage in that discussion during 2024.”

Defective Concrete Blocks

Mr McLaughlin said that the issue of Defective Concrete Blocks has caused great distress in Donegal for several years, with many, many families suffering and having a fear of living in their homes.

He said: “They have had to endure great uncertainty on how the problem can be fixed. The issue continues to dominate discussion in Donegal and further afield.

“The new Government Enhanced Scheme for privately owned properties came into operation in July 2023. It is hoped that it can deliver significant progress in 2023 and beyond. The Council has increased its staff complement to administer the new scheme and already some progress is being made.

“The Council owns an estimated 1,200 social houses with similar defective concrete blocks. “The Council has made a submission to Government seeking approval and funding for these houses and it is understood to be at an advanced stage.”

Housing for All

On the wider issue of housing for all he explained: “The provision of housing is a huge challenge in every county at this stage. The issue generally is affecting many people and families including social housing tenants, people seeking to get on the property ladder, workers moving location and indeed older people looking to “right-size” their home.

"The Minister for Housing launched the new Housing for All plan in late 2021. The Council has developed a

multi-year plan and agreed it with the Department of Housing. It represents a significant investment in high

quality social housing. It includes a number of delivery options including purchasing land/building own

houses, turnkey packages, design/build and direct purchases.

"It is acknowledged that ever since the plan was launched about a year ago, the pressure for social housing

has greatly increased and efforts are being made to further “ramp up” the delivery of social housing. This will

be developed and reported on in more detail under the Capital Budget.

"The provision of homeless services which was quite rare in Donegal in the past is fast becoming an issue in

Donegal and a programme of services must be provided."

Creeslough

Mr McLaughlin also referenced the first anniversary of the village of Creeslough Tragedy being marked on October 7.

“The Council has worked very closely with the Creeslough Community during 2023 and the new Village Plan has obtained Planning Permission and funding is being pursued in 2024."

He recommended that the Council adopt the 2024 Draft Revenue Budget as presented with an Annual Rate of Valuation (ARV) of 0.232 for the County of Donegal.

Commercial Rates

Head of Finance Richard Gibson said that the budget for 2024 includes Commercial Rates income in the sum of €40.3m and will be the first year that Commercial Rates bills will issue under a new government model coordinated by Tailte Éireann.

The revaluation takes account of contemporary rental values in the rating authority area of Donegal County Council

and is designed to achieve a more equitable distribution of Commercial Rates among ratepayers. The new valuations will become effective for rating purposes from January 1 2024.

He said: "In order to achieve the maximum gross Commercial Rates income of €42,114,354 (i.e., the maximum

allowable in accordance with the ministerial order), Donegal County Council would be required to set

an Annual Rate on Valuation (ARV or ‘rates multiplier’) of 0.242 (rounded), which is 4.3% higher than

the indicative Annual Rate on Valuation (‘indicative ARV’) of 0.232 provided to Donegal businesses and

commercial property owners during 2023."

In a detailed presentation crossing many apsects of the running of the council, including overruns he added:

"The total payroll and pension cost for 2024 is €94,159,417 (revenue and capital). Revenue payroll

amounts to €74,504,556.

"Capital payroll amounts to €8,444,543. Pensions amount to €8,739,318, with

the budget for gratuities totalling €2,471,000. Included in the total figure is €11,713,444 in respect of

the Uisce Éireann budget for 2024."

The budget was later passed on the proposal of Cllr Jimmy Kavanagh and Cllr Kevin Bradley seconding the proposals.

Income & Expenditure Movements 2023 – 2024 summary

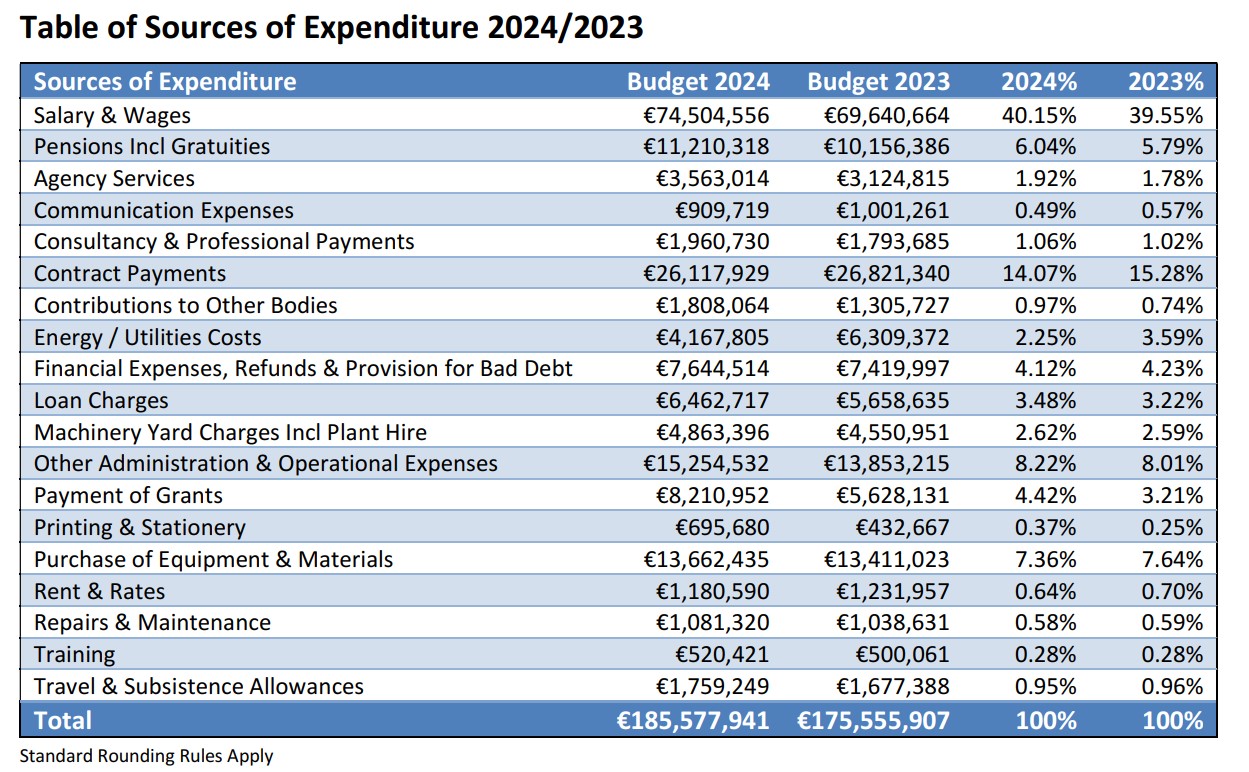

Overall, budgeted expenditure has increased from €175,555,907 in 2023 to an estimated

€185,577,941 in the Draft Budget for 2024, Mr Gibson explained.

The Draft Revenue Budget for 2024 includes the following he said in summary:

- The budget for 2024 includes an additional provision of €400,000 to fund additional

staff resources in the Housing and Building Division.

- The Development Fund Initiative (DFI) has been increased by €185,000 to a total of

€925,000. The increase provides for a total allocation equivalent to €25,000 per elected

member for 2024.

- The Members Development Fund (MDF) has been increased from €234,950 to a total of

€296,000. The increase provides for a total allocation equivalent to €8,000 per elected

member for 2024.

- The Public Lights and Minor Infrastructure Fund has been repeated in the Draft Budget for

2024. The value of the fund is €259,000 (equivalent to €7,000 per Elected Member).

- The specific discretionary allocation for Tidy Towns Groups has been increased to €30,000

per municipal district (an increase of €10,000 per municipal district).

- The Budget for 2024 includes €700,000 for the funding of a fourth phase of the

tourism infrastructure, marketing, and business-activation scheme, which was first

provided for in the adopted budget for 2021. This brings the total value of the scheme to

€2.8m, which is funded from capital account reserves.

- The Revenue Budget for 2024 contains a provision in the sum of €350,000 to

undertake Housing Estate Maintenance works. This was formerly referred to as the ‘backlane programme’ which facilitated upgrading and repair works to access infrastructure in

housing estates. €70,000 has been set aside per MD.

- Income from Roads Grants is anticipated to be broadly in line with allocations received in

2023.

- Revenue account staff payroll and pension costs (excluding Uisce Éireann payroll costs,

which are recoupable in full) have increased by €6,811,659, primarily as a result of the

implementation of national pay agreements and an increase in staff numbers to manage

increasing workloads.

- The Budget for 2024 includes an increase in funding from the Department of Housing,

Local Government & Heritage in the sum of €910,820, which relates to non-discretionary

cost increases arising from the implementation of national pay agreements.

- The budget includes a funding allocation in the sum of €1,750,000 to offset the

increased costs arising from the agreement on pay & conditions with respect to Retained

Fire Fighters. Additional funding will be required in 2024 and in future years to offset the

full-year cost of the agreement. The local government sector will continue to liaise with

central government in this regard.

- Net income from Commercial Rates (excluding the G Factor, which is a contra) has increased

by €390,583 (partly because of buoyancy, i.e., revisions and new property valuations).

- Insurance costs have reduced overall by €135,367 for 2024. The reduction reflects improved

performance on the Council’s insurance book over the last number of years.

- IPB has confirmed the payment of a dividend to Donegal County Council in the sum of

€246,899 for 2024, a decrease of €222,009 on the figure for 2023.

16

- The budget for 2024 includes €100,000 of anticipated income from Non-Principal

Private Residence (NPPR) charges. This is a reduction of €200,000 on the figure included in

the Adopted Budget for 2023. Liability to legacy NPPR charges and penalties is being phased

out over the period 2021 – 2025.

- There is a requirement to maintain a reliance on exceptional measures in order to present a

balanced Revenue Budget for the Members’ consideration. The reliance on exceptional

measures has remained relatively static year-on-year. It is important that the Council

continues to work towards reducing the reliance on exceptional measures in the years

ahead.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.